Treasure Island Income

One of the more common questions about Treasure Island relates to how it generates an income. A similar question that usually follows is how much it generates but we won't go into that much detail here ;)

The island has two direct forms of income - sales of estates and taxation from activities on the island.

Estates

Estate sales involve the estates that have been built on Treasure Island since it was purchased. These estates have a fairly stable value which sits above the prices for most estates and other buildings elsewhere on the planet. This price tag is due to a combination of their position, their size and generous item and guest limits along with the prestige of living on island and being a part of history.

Taxation

Taxation is an ongoing source of income and more important for the long-term operation and development of the island.

Taxes of 4 percent are levied on hunters and miners that carry out their activities on the island.

When a hunter receives loot from their kill or a miner finds resources from the ground a set percentage of the value of their find is automatically and silently deducted and added to the "Tax Pool" before the hunter or miner receives their loot or resources.

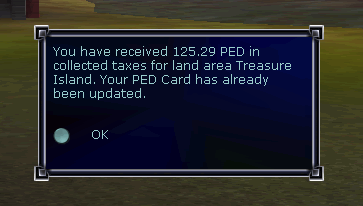

This "Tax Pool" contains no items, no resources, nothing but pure PED and when the pool reaches a certain value (minimum of around 50 PED) it is credited to my PED card and a notification is sent, pictured below, completing the taxation cycle.